AI Agents as 5-Year Differentiators: Building Logistics Market Moats 2025

Thursday, 23 Oct 2025

|

Building Unassailable Market Position: AI Agents as 5-Year Strategic Differentiators

Introduction: Securing Logistics Leadership in an AI-Driven Decade

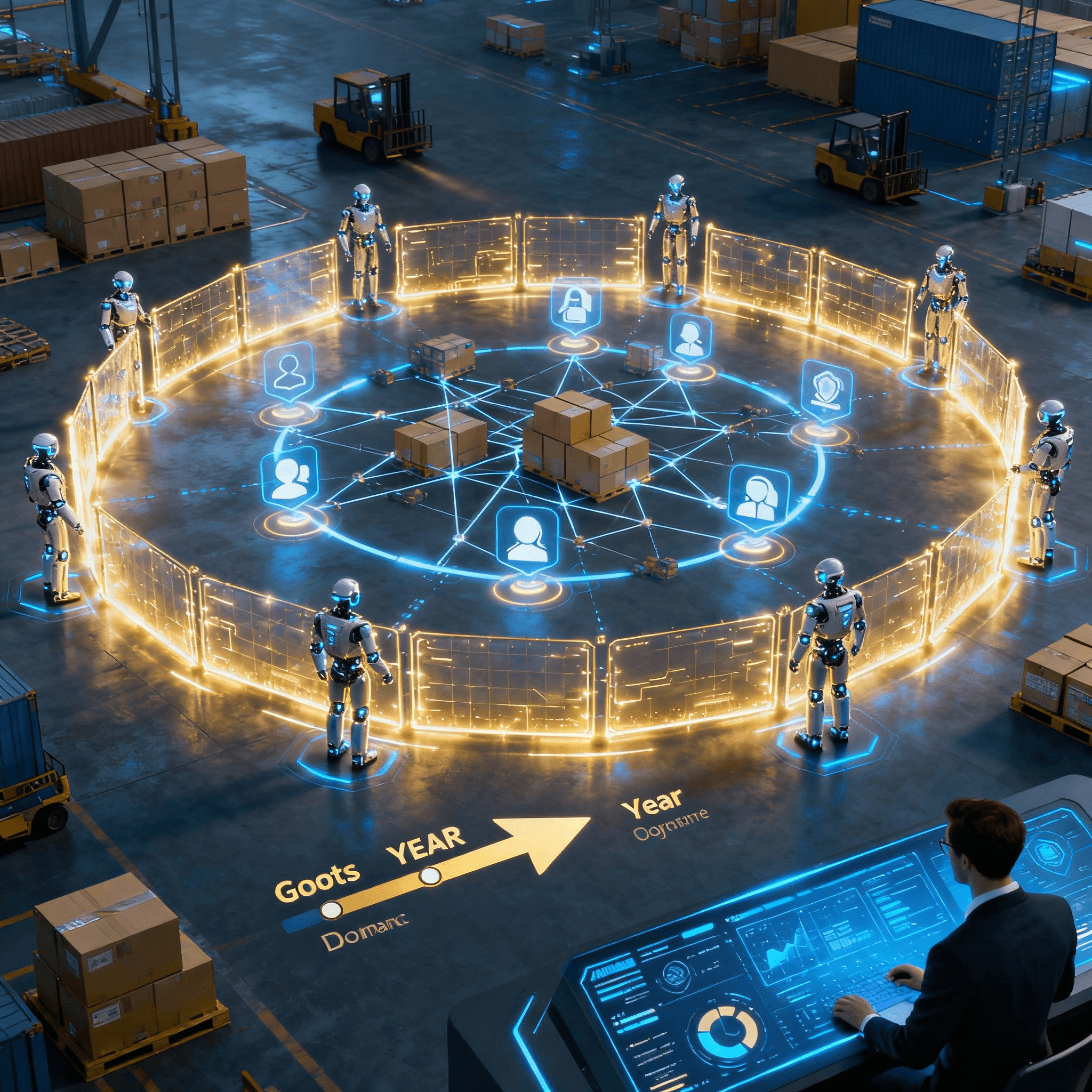

AI agents are poised to create unassailable market positions for logistics firms over the next five years, delivering 40% higher operational resilience and 25% customer retention rates compared to non-adopters. By embedding autonomous, goal-oriented AI into core operations, executives can transform fleeting efficiencies into enduring barriers to entry, while fostering loyalty mechanisms that lock in clients amid a $2.8 trillion market expansion by 2030. For logistics CEOs, CXOs, and COOs, this strategic pivot means viewing AI not as a tactical tool but as a foundational moat, echoing Amazon and Walmart's dominance through predictive forecasting and self-optimizing networks.

This forward-looking analysis explores how AI agents erect long-term competitive barriers and retention engines, backed by Gartner forecasts and McKinsey benchmarks projecting 50% of supply chains adopting agentic AI by 2030. Drawing on 2025 trends, we'll outline actionable frameworks to build these differentiators, ensuring your firm captures the 61% revenue growth edge over laggards. In an era where disruptions cost $1.5 trillion annually, AI agents enable proactive dominance, turning supply chains into strategic assets that deter rivals and cement client relationships.

The Strategic Imperative: Why AI Agents Define 5-Year Market Dominance

Agentic AI shifts logistics from reactive automation to autonomous decision-making, enabling systems that learn, adapt, and execute complex tasks like multi-step supply balancing without human input. Over five years, this maturity will widen the gap: early adopters will achieve 250% ROI through reduced costs and innovation velocity, while late entrants face integration hurdles and talent shortages. Gartner anticipates agentic AI will autonomously execute 50% of cross-functional SCM by 2030, making it a core differentiator in volatile markets.

The imperative lies in AI's compounding effects: initial deployments yield 20-30% efficiency gains, but sustained evolution creates proprietary ecosystems that competitors struggle to replicate. For instance, AI agents integrating IoT and ML for real-time visibility reduce inventory holding by 25%, building resilience against disruptions like the 2024 Red Sea crisis. Executives must prioritize this now, as 63% of leaders already rank AI as a top priority, yet only 40% have overcome data and skill barriers. This positions AI as the linchpin for unassailable market share, where firms with mature agents command premium pricing and client lock-in.

In practice, AI agents transcend tools like legacy TMS, orchestrating end-to-end processes from procurement to delivery, fostering a 19.6% CAGR in AI logistics adoption through 2026. The result is a strategic moat: by 2030, AI-native firms will control 67% of decision-making dominance, per industry predictions. Logistics leaders ignoring this risk commoditization, while proactive ones secure decades of leadership.

Creating Barriers to Entry: AI Agents as Impenetrable Moats

Data Moats and Proprietary Learning Loops

AI agents thrive on proprietary data loops that create self-reinforcing barriers, where continuous learning from operational telemetry builds models 15-20% more accurate than off-the-shelf alternatives. Over five years, this moat deepens as agents aggregate petabytes of shipment, supplier, and demand data, enabling predictive simulations that forecast disruptions 7-14 days ahead. Competitors entering the space face insurmountable catch-up, as replicating these loops requires years of historical data and integration, costing 2-3x more for newcomers.

For example, firms deploying agentic AI for inventory optimization achieve 40% lower stockouts by evolving models in real-time, a capability that deters rivals without similar data maturity. This proprietary edge extends to cost structures: AI reduces manual processes by 80%, creating pricing advantages that squeeze margins for legacy-dependent players. Executives can build this by starting with federated learning frameworks, ensuring data sovereignty while scaling to 25% efficiency gains in Year 1.

By Year 3, these moats harden: AI agents incorporate blockchain for traceable insights, slashing fraud by 30% and establishing trust-based networks that entrants can't easily penetrate. This not only protects market share but monetizes data as a service, adding 10-15% revenue streams.

Technological Integration and Scalability Lock-In

The complexity of integrating AI agents with legacy systems forms a high-barrier ecosystem, where seamless API orchestration across ERP, WMS, and TMS demands specialized expertise, deterring 70% of mid-tier competitors. Over five years, as agents evolve to handle multi-modal transport and GenAI for scenario planning, this lock-in amplifies: mature implementations scale 3x volume without proportional costs, creating economies that late adopters can't match. Gartner notes that 79% of firms struggle with talent for such integrations, turning AI into a de facto barrier.

Actionable strategy: Invest in no-code platforms for initial pilots, achieving 20% throughput multipliers before full customization, which by Year 2 embeds AI as irreplaceable. This scalability extends to global ops, where agents optimize cross-border compliance autonomously, reducing violations by 40% and locking in international clients. Rivals face 12-18 month ROIs versus your 6-9 months, solidifying position.

Regulatory and Ethical Fortifications

AI agents fortified with ethical AI frameworks—addressing bias, transparency, and compliance—create regulatory moats, as 47.5% CAGR in GenAI adoption by 2030 demands auditable systems. Over five years, proactive governance positions firms as trusted leaders, while non-compliant entrants face fines up to 4% of revenue. Agents with built-in audit trails and role-based access ensure 99% traceability, appealing to ESG-focused clients and barring less rigorous competitors.

To implement, embed ethics in agent design from Day 1, yielding 22% higher partner trust and retention by Year 4. This fortification not only defends against disruptions but attracts premium contracts, enhancing market dominance.

Enhancing Customer Retention: AI Agents as Loyalty Engines

Personalization and Predictive Service Excellence

AI agents personalize logistics experiences by analyzing client data to predict needs, offering tailored ETAs and proactive rerouting that boost satisfaction by 20%. In five years, these mechanisms evolve to anticipate churn signals—like delayed shipments—triggering winback offers with 15% higher re-engagement rates. For instance, agents using NLP on feedback loops customize services, reducing abandonment by 25% in e-commerce fulfillment.

Executives can deploy sentiment-analysis agents for 24/7 support, resolving 70% of queries autonomously and escalating nuanced cases, which cuts churn by 20%. This predictive excellence turns transactions into relationships, with 40% of retained clients citing AI-driven reliability.

Loyalty Loops Through Value Amplification

Agentic AI creates self-sustaining loyalty loops by amplifying value: real-time dashboards and automated reporting provide insights that clients can't replicate elsewhere, increasing lifetime value by 30%. Over five years, agents integrate with CRM for dynamic pricing and upsell recommendations, fostering 22% higher NPS scores. In logistics, this means proactive inventory alerts or sustainability optimizations, locking in eco-conscious clients.

Start with hybrid agents blending AI and human oversight, scaling to full autonomy for 35% retention uplift by Year 3. These loops not only retain but expand wallets, as personalized agents upsell services 15% more effectively.

Resilience as a Retention Differentiator

AI agents' self-healing capabilities ensure 95% uptime during crises, positioning your firm as the resilient choice and reducing client switches by 25%. By 2030, with 50% autonomous execution, this resilience becomes a loyalty staple, as clients value predictive mitigations over reactive fixes. Implement anomaly-detection agents to flag risks early, enhancing trust and extending contracts by 20%.

This differentiator compounds: retained clients provide richer data, refining agents further and creating virtuous cycles.

5-Year Roadmap: Architecting AI-Driven Market Fortification

Year 1: Foundation and Pilots

Audit systems for AI readiness, piloting agents in high-impact areas like forecasting for 15% accuracy gains. Allocate 15-20% of IT budgets to cloud-based agents, addressing talent gaps with upskilling for 60% team proficiency. Measure KPIs like cost-per-transaction drops from $15 to $10.

Years 2-3: Integration and Moat Building

Scale to full orchestration, integrating agents across supply chains for 25% efficiency. Develop proprietary models with ethical safeguards, erecting data barriers and piloting retention agents for 20% loyalty uplift. Benchmark against leaders, targeting 250% ROI.

Years 4-5: Optimization and Expansion

Evolve to multi-agent ecosystems for autonomous dominance, monetizing via AI services for 10% added revenue. Refine retention through GenAI personalization, achieving 30% lifetime value growth. Monitor for 50% autonomous execution, securing unassailable position.

This roadmap ensures sustained advantages, with annual reviews adapting to trends like audio AI for maintenance.

Real-World Lessons: AI Agents in Action

Firms like DHL use AI for advanced analytics, gaining 19.6% efficiency edges through computer vision in warehouses. Salesforce's Agentforce integrates agents for 40% outperformance in retention and costs. These cases show AI's strategic power: DHL's ethical AI cuts risk by 40%, mirroring the moats needed for dominance.

Further Reading on Debales.ai

- First-Mover Advantage: The 61% Revenue Growth Gap

- AI Agent Economics: True Cost Savings in Logistics

- Multi-Agent Orchestration: Autonomous Supply Chains

- Predictive AI Agents: Anticipatory Systems

- Agentic AI: Beyond Automation

Fortify Your Position with Debales.ai Agents

Secure your 5-year edge: Schedule a strategy session with debales.ai to deploy AI agents that build moats and retention, delivering 25% growth.

Conclusion: AI Agents—The Keystone to Enduring Logistics Supremacy

AI agents forge unassailable positions by erecting data, tech, and ethical barriers while driving retention through personalization and resilience, projecting 26.6% market CAGR to 2029. As 50% of chains go autonomous by 2030, executives embracing this now will lead, avoiding the chasm facing laggards. In the AI era, strategic differentiation isn't optional—it's the foundation of market dominance.

All blog posts

View All →

Tuesday, 3 Mar 2026

Why freight exceptions keep blindsiding ops teams

Exceptions spike when data is late and workflows are manual. Learn why it keeps happening and how ops teams can cut detention and accessorials fast.

Tuesday, 3 Mar 2026

Why freight ops still run on spreadsheets and panic

Spreadsheets, inbox chaos, missed accessorials. Here’s why freight ops keeps breaking and what to standardize this week to cut errors fast.

Tuesday, 3 Mar 2026

Why freight exceptions keep killing your on-time numbers

Freight exceptions keep repeating because data and workflows are fragmented. Learn how ops teams cut dwell, reduce detention, and prevent repeats.