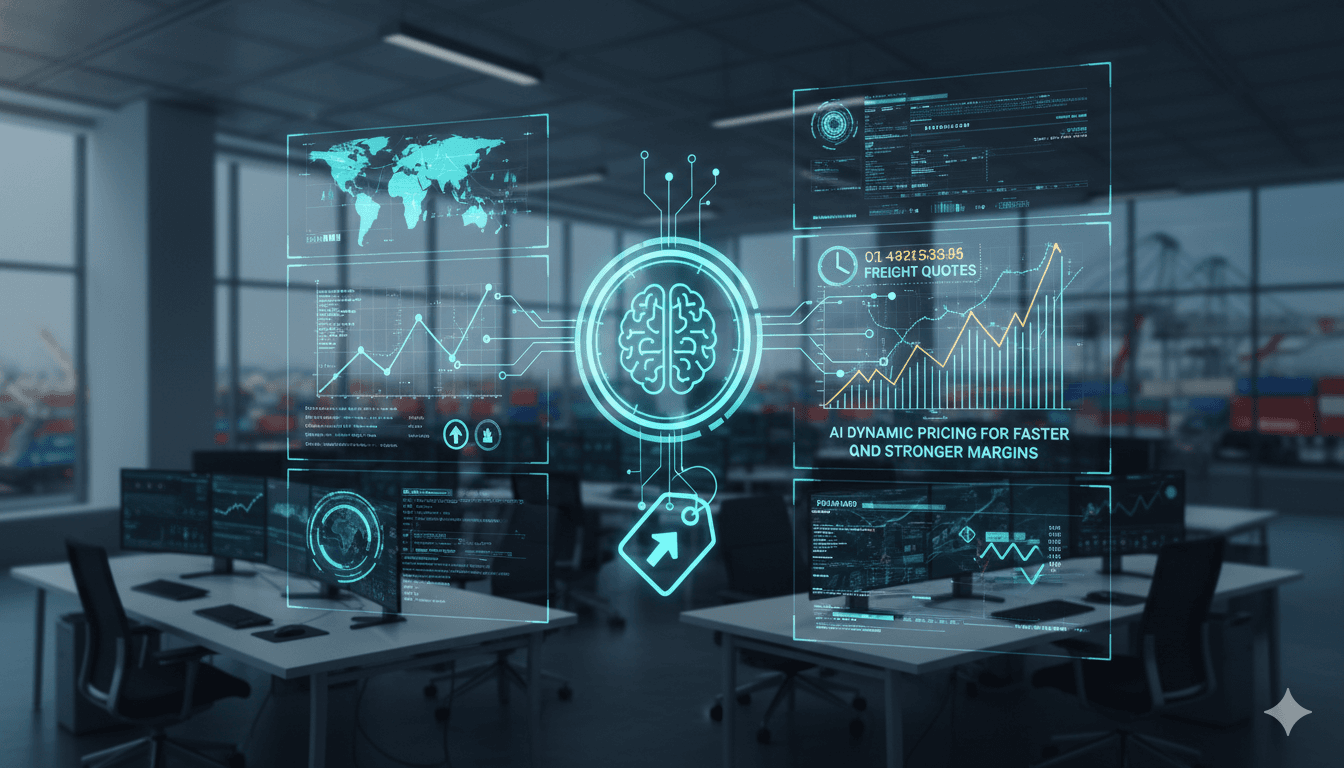

AI Dynamic Pricing for Faster Freight Quotes and Stronger Margins

Wednesday, 28 Jan 2026

|

It is uncomfortable to admit, but a lot of freight pricing is still run on improvisation. The quote gets out the door, the load covers, and the team moves on. If you are seeing inconsistent margins, slow responses, or last minute repricing, it looks like work, not failure. People are hustling. The issue is the system you are asking them to operate in: too many pricing decisions, too little evidence, and not enough time to apply it consistently.

The stakes are higher now because the mix is harder. Spot is volatile, contract rate risk is real, and customer expectations on response time keep tightening. In that environment, even competent teams leak margin through tiny, repeated decisions: which comparable lanes you trust, how you adjust for current capacity, and where you set the buy sell rate spread when the market shifts inside the day.

Why strong teams normalize bad pricing hygiene

Freight brokerage pricing problems rarely show up as one dramatic failure. They show up as a stable pattern of heroics.

Heroics become the operating model

The best reps learn the fastest paths: call the carrier that usually answers, use a personal mental model of the lane, and push the quote with a safe buffer. It works often enough that the process never gets rebuilt.

Tribal memory replaces shared rate intelligence

When pricing guidance lives in people, the org is fragile. New hires copy whatever is loudest in the pod. Senior reps keep a private spreadsheet. Procurement rate analytics might exist, but it is not tied to the moment a quote is built.

Urgency beats consistency

When the customer wants an answer in minutes, the path of least resistance wins. The team does not choose inconsistency; the workflow forces it. Faster freight quoting becomes the KPI, and buy sell rate optimization becomes optional.

Symptom checklist you can observe this week

If your team is dealing with any of the below, you are not alone. These are visible signs of margin leakage and decision risk:

1) Quotes take longer than they should because reps hop between TMS screens, spreadsheets, and message threads to triangulate a rate.

2) The same lane gets materially different sell rates depending on who quoted and what time of day it came in.

3) More loads require post acceptance repricing, carrier fall offs, or internal escalation because the initial buy target was unrealistic.

4) Contract bids look fine at award, then drift into negative surprise as spot conditions change and the floor price is not enforced.

5) Managers spend time auditing after the fact instead of steering decisions in the moment.

The quiet math: how small pricing variance turns into real loss

You do not need a dramatic miss to feel it. Consider a scenario where a brokerage team quotes 120 spot opportunities per day across a pod. Use conservative, adjustable assumptions:

- Average quote size: $1,900 linehaul plus accessorials (use your own average)

- Win rate today: 22%

- Loads moved per day from those quotes: 26

- Average gross margin per load: $175

- Margin leakage from inconsistent pricing decisions: $20 per load (not a benchmark, an illustrative number)

In that scenario, $20 of leakage across 26 loads is $520 per day. Over 20 working days, that is $10,400 per month.

Now add time. Imagine each quote requires 6 minutes of rate gathering, manual adjustment, and internal confirmation. If you could reduce that to 3 minutes without increasing buy risk, you free 3 minutes per quote. Across 120 quotes, that is 360 minutes per day, or 6 hours of selling time. If even a portion of that time increases throughput or improves quote win rate by a small amount, the impact stacks.

Finally, look at contract rate risk. Suppose you manage 400 contract loads per month on lanes where spot conditions periodically spike. If you miss the risk signal and hold sell rates while buy climbs, the bleed can be sudden. Even a $35 per load gap for a subset of 80 loads is $2,800 that month. Again, adjust the assumptions, but the pattern is common: small per load variance plus repetition equals real dollars.

If you want help identifying where this cost hides in your workflows, we run short working sessions to map the top two leak points.

What AI dynamic pricing changes in practice

AI dynamic pricing is not a promise of perfect forecasts. It is a way to make pricing decisions repeatable and evidence based inside the workflow, using rate intelligence signals that update as the market moves.

Rate intelligence that supports the decision you must make

Most teams do not need more charts. They need a confident answer to a few operational questions:

- What is the likely buy range right now for this lane and equipment?

- How wide is the uncertainty, and what is the downside if we are wrong?

- What is the minimum sell rate we should defend given service expectations and pickup window?

- Is this quote competing in spot conditions that are trending up, down, or unstable?

Spot rate prediction is useful when it is framed as decision guidance: not a single number, but a range with confidence and a reason you can explain.

Buy sell rate optimization as a controlled policy, not a vibe

When a rep sets a sell rate, they are choosing a spread and a risk position. With pricing automation, you can encode policies that match your strategy:

- Different spread targets by customer segment, service level, and lead time

- Guardrails that block quotes below a floor unless there is an explicit approval path

- Automatic adjustments when carrier capacity indicators change inside the day

- Separate logic for volatile lanes versus stable lanes

The goal is to reduce margin leakage by removing random variance. Not by removing human judgment, but by standardizing what judgment is allowed to do.

Procurement rate analytics where it actually matters

Procurement teams often have useful carrier and lane insight, but it is rarely applied at the quote moment. When procurement rate analytics feeds pricing, the org stops re learning the same lessons:

- Carrier performance and acceptance behavior influences the buy target

- Historical tender acceptance can inform how aggressive you can be

- Seasonality and pickup day patterns can be reflected in the buy range

Work about work that slows quotes and weakens margins

Here is the typical hidden workload behind faster freight quoting. None of it is hard. It is just repetitive and easy to do differently each time.

Micro tasks reps repeat on every quote

- Search recent similar lanes and decide which ones are comparable

- Adjust for pickup day and time window

- Guess how much the market moved since the last data point

- Decide whether to include a buffer, and how big

- Ping a carrier contact for a quick feel, then wait

- Ask a manager for approval on an exception

- Re key the same numbers into email, TMS, and CRM notes

Micro tasks managers repeat to control risk

- Review outlier quotes after the fact

- Explain margin misses to leadership

- Write one off rules that never get enforced consistently

- Set informal guidance that changes with mood and market noise

This is where pricing automation earns its keep: by making the default behavior the correct behavior, and by recording the reasoning so the team can learn.

A practical 30 minute exercise to find your first two fixes

Do this with a pricing lead, a senior rep, and someone from procurement or carrier ops. Timer on. The goal is not a perfect map. It is to identify your first two leak points.

Step 1 (10 minutes): Pick one lane and replay three recent quotes

Choose a lane that appears often. Pull three quotes from the last two weeks: one that won cleanly, one that lost, and one that won but later required repricing. For each, write down:

- Initial sell rate, final sell rate

- Initial buy target, final buy

- Time to first quote response

- What evidence was used to set the number

Step 2 (10 minutes): Mark the decision points that were unstructured

Circle where the process depended on interruption or memory:

- Which data sources were checked

- Where a buffer was added without a rule

- Where a manager approval was needed

- Where carrier availability was assumed rather than confirmed

Step 3 (10 minutes): Define two policies you wish existed

Write two simple policies that, if enforced, would have prevented the messy outcome. Examples:

- For pickup within 24 hours on this lane, do not quote below a defined floor unless a named carrier has soft committed.

- If the spot signal is trending up, increase the buy target range and reduce time allowed before reconfirming.

If you can write the policy in one sentence, it can usually be operationalized.

But we already have automation…

Many teams do. The issue is what the automation actually covers.

If your tools automate booking, tracking, and documentation, you are still left with the hardest part: deciding the rate under uncertainty. Some systems can store a rate, pull an average, or alert on exceptions. That helps, but it does not close the loop between spot rate prediction, contract rate risk, and the exact moment the rep commits a number to a customer.

Ask two questions:

- Does the tool recommend a buy range and a sell range with confidence, and explain why?

- Does it enforce pricing policy in workflow, or does it just report after the fact?

If the answer is mostly reporting, you will keep paying the tax of variance and rework.

At this point, most teams ask the same question: if this isn't a people problem, and it's not solved by more dashboards or alerts — what actually changes the outcome?

Traditional systems are designed to record and notify. The gap shows up where decisions, evidence, and follow-through still depend on human interruption.

Closing: what to aim for in the next 60 days

A realistic near term target is not perfect pricing. It is controlled pricing.

- One shared definition of rate intelligence inputs you trust for quoting

- Clear buy sell rate optimization rules for your top lanes

- A way to quantify contract rate risk and defend floors before the month turns

- Fewer escalations because exceptions are structured, not ad hoc

- Faster freight quoting because the decision path is shorter and more consistent

If you want a practical working session to map your first policies and where pricing automation should sit in your workflow, we can show how teams operationalize the fixes.

https://debales.ai/book-demo?utm_source=website&utm_medium=blog&utm_campaign=ai-dynamic-pricing-for-faster-freight-quotes-and-stronger-margins&utm_content=dynamic-pricing-margins