Cross-Border Trade Automation in 2025: AI for Customs, HS Classification, and e-Documentation at Scale.

Friday, 7 Nov 2025

|

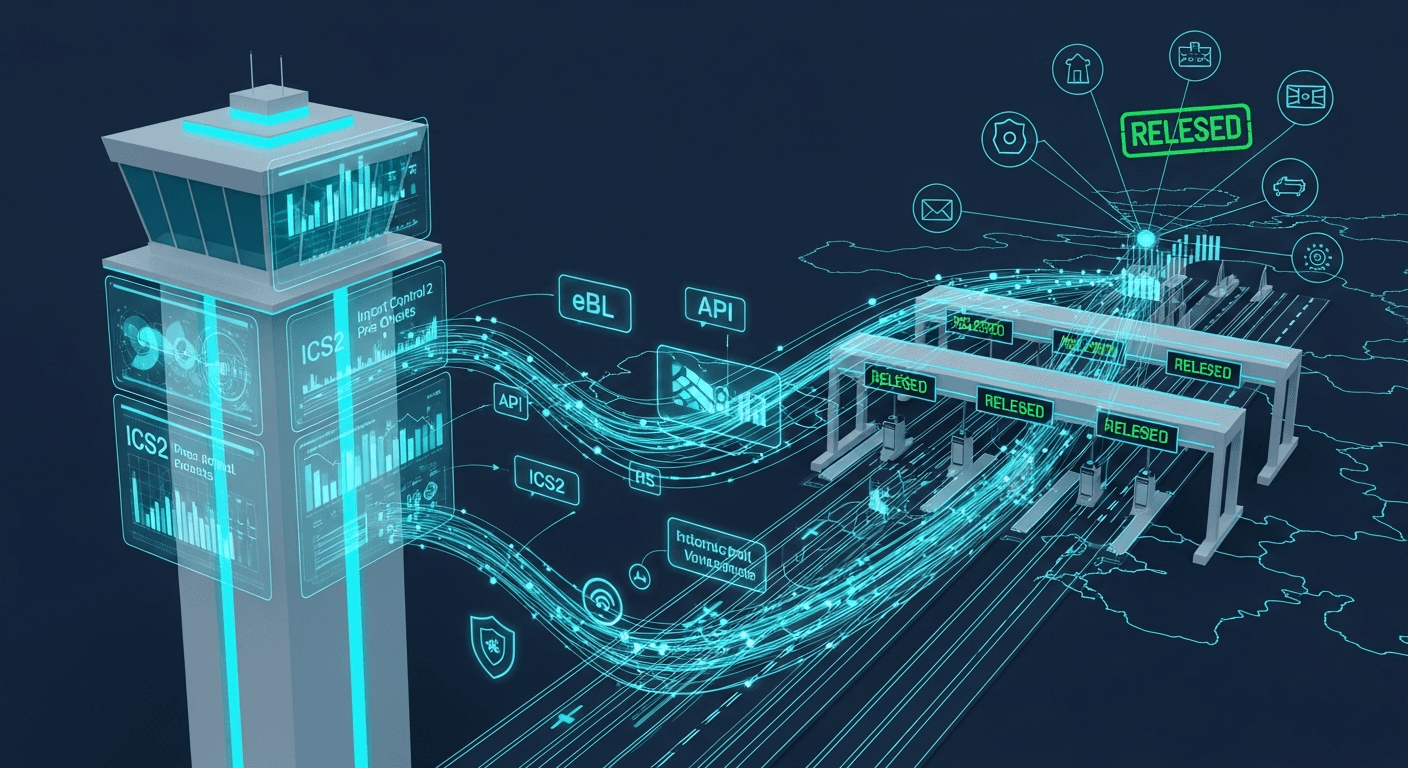

AI now automates cross-border compliance by classifying products, generating and validating documents, and synchronizing data with customs systems, cutting clearance times, errors, and penalties while improving supply chain visibility and cash flow. By combining HS code automation, e-documentation, and multi-jurisdictional rules engines aligned to EU ICS2, UK CDS, and other regimes, trade teams can scale international shipping with confidence and audit-ready controls in 2025.

Introduction

International shipping remains paperwork-heavy and error-prone, with misclassification and incomplete declarations causing holds, rework, and fines across thousands of routes and regimes. The convergence of AI-driven HS classification, electronic bills of lading, and pre-arrival security filings such as the EU’s ICS2 enables automated, compliant flows from purchase order to border release. This guide distills how to automate customs documentation, tariff classification, and multi-jurisdictional compliance, with frameworks and examples executives can use to reduce cycle times and risk at scale.

Why automate now

- Regulatory timelines are tightening, with ICS2 becoming mandatory across all EU transport modes by September 1, 2025, raising the bar for data completeness and timeliness.

- AI models from customs bodies and industry routinely exceed 80% accuracy in HS recommendations, slashing rework and detention risk from misclassification.

- Digital trade docs such as eBLs promise billions in systemic savings and fraud reduction, accelerating end-to-end digitization across carriers and ports.

Core automation pillars

1) Tariff classification with AI

Automated HS classification uses NLP on product descriptions, specifications, and historical declarations to recommend codes with probabilistic confidence and rationale. The WCO’s BACUDA initiative demonstrates how customs-grade models assist officials and traders by translating commercial descriptions into HS code candidates with explainability and statistics. Best-in-class systems enrich classification using catalog attributes, GTINs, chemical identifiers, and prior rulings to increase accuracy and consistency across SKUs and markets.

Key practices:

- Maintain a golden record of product master data with features mapped to HS decision criteria and store audit trails of code decisions and overrides.

- Use human-in-the-loop for ambiguous items and borderlines, escalating to binding rulings where uncertainty or duty impact is material.

- Continuously retrain on customs outcomes, post-entry corrections, and enforcement feedback to reduce future misclassification risk.

Value and risk:

- Correct classification avoids duty under/overpayments, penalties, and shipment holds, improving landed cost accuracy and predictability.

- Accuracy above 85% has been reported for automated classification, with the remainder handled via expert review and rulings.

2) Digital documentation and eBL

Digitizing core documents—commercial invoices, packing lists, certificates of origin, bills of lading, and compliance certificates—removes manual handoffs and accelerates vessel and border milestones. Electronic bills of lading using ICC standards reduce printing, courier, and processing costs while hardening against fraud and enabling real-time visibility for multiple parties. McKinsey-cited analysis indicates eBL adoption could save stakeholders around $6.5 billion annually through efficiency and error reduction.

Key practices:

- Adopt ICC eBL standards and integrate with carrier and port platforms to ensure end-to-end acceptance and title transfer integrity.

- Normalize data models across documents so a single source populates declarations, invoices, and transport docs without re-keying.

- Apply digital signatures and tamper-evident storage to support legal admissibility and reduce fraud risk during financing and customs interactions.

3) Multi-jurisdictional compliance engines

A rules engine that encodes customs schemas, safety and security data, trade program eligibility, and sanctions screening enables consistent filings across jurisdictions. The EU’s ICS2 phases require complete Entry Summary Declarations and support multiple filing across supply chain actors, demanding precise data orchestration before arrival. Engines should template country-specific datasets and validation checks for regimes such as EU ICS2, UK CDS, and partner single windows, with APIs to submit and reconcile responses.

Key practices:

- Maintain canonical shipment and item models mapped to each regime’s data elements, including HS, origin, valuation, and security particulars.

- Implement pre-submission validation to catch missing or inconsistent data, and orchestrate multi-filer responsibilities aligned to ICS2’s multiple filing framework.

- Store acknowledgments, risk messages, and released statuses as system-of-record evidence for audits and disputes.

Process blueprint: click-to-clear

1) Product onboarding and HS governance

Centralize product attributes, classify with AI, and route uncertain cases to specialists or seek binding rulings for high-risk goods. Version every code decision with evidence and attach to the product master, ensuring downstream filings reuse a verified classification.

2) Shipment creation and document pack generation

From PO or sales order, auto-generate commercial invoice, packing list, and origin documentation using master data and trade program rules. Generate carrier-specific eBL or e-AWB data and synchronize with port and carrier platforms to align cutoffs and title exchange.

3) Pre-arrival filings and risk screening

Assemble and validate the ENS dataset for ICS2 with multi-party inputs, submit via STI or approved interfaces, and monitor for risk queries. Screen counterparties and items against sanctions and trade restrictions and attach screening evidence to the declaration record.

4) Arrival, release, and post-entry

Ingest customs responses, resolve queries using linked document evidence, and capture release events across entries and modes. Post-entry corrections and reconciliations feed back into HS and valuation models for continuous improvement and compliance learning.

Technology reference model

- Data layer: product master, tariff libraries, rulings, trade programs, and document templates with lifecycle control.

- AI services: HS classifier, anomaly and data completeness validators, and document extraction for supplier paperwork normalization.

- Integration: APIs to customs systems, carrier and port platforms, and financial systems for duties, VAT, and trade financing workflows.

- Control tower: dashboards for SLA tracking, clearance times, exceptions, and audit evidence packaging with drill-down to item and filing levels.

Regulatory watch: 2025 highlights

- ICS2 Release 3 extends to road and rail with full operational status across EU Member States on September 1, 2025, mandating complete ENS data.

- Economic operators must connect via the Shared Trader Interface or Customs Trader Portal, with onboarding needed to avoid border delays.

- Multiple filing expands to all modes, enabling split responsibilities but requiring robust orchestration among supply chain actors.

Case signals and lessons

- Maersk and IBM’s digital documentation initiatives highlight how digitized trade documents reduce delays, cost, and fraud, while improving visibility across stakeholders.

- DHL’s global automation programs show enterprise-scale process digitization is achievable across countries and ERPs when standardized data and document flows are enforced.

- WCO’s HS AI support demonstrates regulator-aligned automation is viable and improves both facilitation and compliance accuracy.

Operating model and controls

- Assign ownership: trade compliance leads steward rules and HS governance; operations own document timeliness; IT secures integrations and data.

- Embed human-in-the-loop: require expert review gates for high-duty, high-risk, or ambiguous classifications and for sanctioned-party hits.

- Evidence by design: archive filings, messages, and document versions with signatures to meet audit standards and accelerate disputes and post-entry adjustments.

ROI and KPIs

Executives should track clearance time reduction, detention rate, rework rate, HS dispute rate, first-time-right filings, and duty/VAT accuracy to quantify impact. eBL and document automation reduce document cycle costs and fraud, while HS automation and ICS2-ready data flows cut holds and penalties, yielding fast payback.

Implementation roadmap

- 0–60 days: product master cleanup, AI HS pilot on top SKUs, document template normalization, and ICS2 data gap assessment.

- 60–120 days: integrate eBL with pilot carriers, enable ENS pre-validation, and expand HS automation with expert review and retraining loop.

- 120–180 days: connect to STI/portals, roll out multi-filing orchestration, and stand up the control tower with audit evidence packaging.

Risk management

- Misclassification risk: mitigate with confidence thresholds, escalation paths, and periodic sampling audits against customs outcomes.

- Data and fraud risk: use digital signatures, immutable logs, and role-based access for documents and filings across partners.

- Regulatory change risk: subscribe rules to authoritative updates and maintain regression suites to test filings as schemas evolve.

Future outlook

AI will progress from recommendation to self-filing assistants that pre-build entries, request missing data, and negotiate multi-filer splits under ICS2 and similar regimes. Wider e-document acceptance and single-window integrations will compress lead times and reduce capital tied in transit, improving resilience and competitiveness.

Call to Action

Build a compliant, automated cross-border engine in 90 days—map your HS governance, digitize your document pack, and go live with ICS2-ready filings with a tailored plan. Schedule a Demo

Conclusion

Automating tariff classification, documentation, and pre-arrival compliance turns border clearance into a predictable, auditable, and faster process that lowers cost and risk. With ICS2 deadlines and digital documentation tailwinds, organizations that invest in AI-driven classification, eBL, and rules-driven filings will move goods with fewer detentions, better duty accuracy, and stronger cash cycles.

All blog posts

View All →

Thursday, 26 Feb 2026

Detention keeps rising because our processes reward it

Detention and accessorials keep blowing up budgets. Learn why it keeps happening and what ops teams can change this week to cut charges 10-30%.

Thursday, 26 Feb 2026

Why freight exceptions keep blindsiding ops teams

Stop getting surprised by missed pickups, OS&D, and detention. Learn why exceptions keep recurring and how to build a weekly fix loop.

Thursday, 26 Feb 2026

Why accessorials keep blowing up your freight budget

Accessorial charges pile up from bad data, unclear rules, and weak proof. Fix detention, lumper, and reclass costs with tighter processes.