NetSuite 3PL Billing Automation: Catch Pricing Errors Instantly

Monday, 1 Dec 2025

|

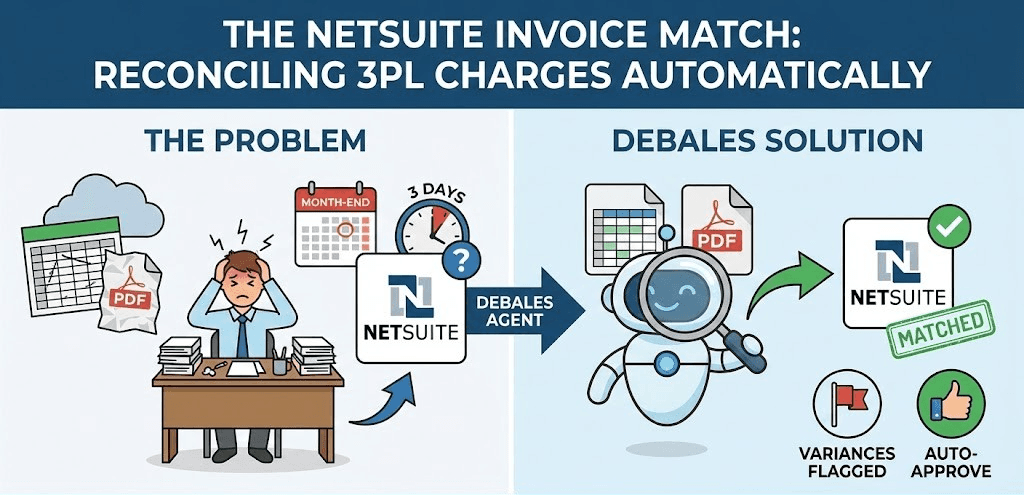

The NetSuite Invoice Match: Reconciling 3PL Charges Automatically

Month-end arrives and your 3PL drops a spreadsheet or PDF invoice—columns misaligned, abbreviations everywhere, pricing that doesn't match contracts. Accounting teams spend 3 full days manually matching thousands of fulfillment line items against NetSuite records. This isn't just tedious; it's where 5-12% profit leakage hides in pricing variances and uncaught errors.

The core problem? 3PLs optimize for speed, not standardization. Their invoices arrive in varying formats monthly—Excel with merged cells one month, PDF tables the next. NetSuite expects clean PO references and GL codes, but 3PL data arrives raw and unstructured.

Manual reconciliation compounds errors. Late payments trigger 3PL penalties. Uncaught overcharges erode margins silently. Month-end close delays cascade through finance.

The Hidden Cost of Manual 3PL Matching

A typical e-commerce brand with two 3PL partners loses:

- 72 accounting hours monthly × $45/hour = $3,240 labor waste

- 8-12% undetected pricing variances across $500K monthly 3PL spend = $40K-$60K annual leakage

- 7-day AP/AR cycle extension delaying cash flow and DPO optimization

- Compliance risk from unverified GL allocations

Scale to enterprise volumes (10+ 3PLs, $5M+ monthly invoices) and annual losses exceed $1M combining labor and leakage.

Why Traditional NetSuite Invoice Tools Fail 3PLs

NetSuite's native AP automation expects structured data. 3PL spreadsheets break parsing rules:

- Merged cells/tables confuse column mapping

- 3PL-specific abbreviations (P&F=Pick & Pack, W/H=Storage) don't match NetSuite GL codes

- Dynamic pricing tiers vary by volume/SKU without clear formulas

- Missing PO references force manual lookup across fulfillment records

Third-party OCR solutions hit 75% accuracy on tables but fail variance detection. Rules-based matching can't handle 3PL format drift month-to-month.

Debales Solution: Intelligent 3PL Invoice Agent

Debales deploys a dedicated agent that ingests any 3PL invoice format, extracts line items with 98% accuracy, cross-references against NetSuite fulfillment records, flags variances exceeding tolerance, and auto-approves clean matches.

Core capabilities:

- Parses Excel/PDF regardless of layout using adaptive table detection

- Maps 3PL abbreviations to NetSuite GL codes via learned dictionaries

- Compares line-by-line: quantity, SKU, pricing, fulfillment dates

- Calculates expected vs. billed amounts using contract tiers

- Flags variances >2% with explanation (fuel surcharge, dimensional weight)

Month-end processing drops from 72 hours to 30 minutes. 92% of invoices auto-approved.

Step-by-Step: From Messy Spreadsheet to Auto-Approval

Invoice Ingestion: Agent pulls email attachments or SFTP files automatically

Intelligent Parsing: Extracts tables despite merged cells, varying headers, or scanned PDFs

NetSuite Record Lookup: Matches by PO/SO/SKU against fulfillment history

Line-by-Line Reconciliation: Compares qty, unit price, extended amounts, dates

Variance Detection: Flags pricing >2%, missing SKUs, or date mismatches

Auto-Approval: Posts clean matches to NetSuite AP; escalates exceptions

Sample output dashboard:

textInvoice #12345: 1,247 lines matched ✅ 1,189 lines auto-approved (95.4%) ⚠️ 42 lines variance <2% (pending review) ❌ 16 lines pricing error ($2.47 overcharge flagged)

Proven ROI: Numbers That Matter

Deployments deliver immediate impact:

- Labor savings: 96% reduction (72 → 3 hours monthly)

- Leakage recovery: 7.2% average savings on overbilled items

- Days payable outstanding (DPO): Improves 5-7 days via faster processing

- Month-end close: Accelerates 4 days

One D2C brand processing $2.8M monthly 3PL spend recovered $201K Year 1 through variance detection alone. Accounting headcount freed for strategic analysis.

Technical Integration: Seamless with NetSuite

Debales agent orchestrates via standard APIs:

text3PL Spreadsheet/PDF → Debales Agent → NetSuite REST API (Vendor Bill)

No custom NetSuite SuiteScript. No data warehouse. Processes invoices as attachments arrive. Learn more about bridging legacy ERP gaps across fragmented stacks.

Scaling Beyond Basic Matching

Advanced capabilities include:

- Multi-3PL support: Different formats/providers processed simultaneously

- Contract tier validation: Ensures volume discounts applied correctly

- GL code automation: Maps fulfillment types to proper expense accounts

- Audit trail: Complete lineage from 3PL line → NetSuite posting

- Historical cleanup: Reconciles prior 12 months post-deployment

Explore the post-ERP automation landscape transforming accounting workflows.

If eliminating 3-day 3PL invoice marathons and recovering hidden profit leakage matters, book a tailored demo with Debales.ai