61% Revenue Gap: AI-Native vs. Traditional Logistics First-Movers

Monday, 20 Oct 2025

|

First-Mover Advantage: The 61% Revenue Growth Gap Between AI-Native and Traditional Logistics

Introduction: The Widening Chasm in Logistics Competition

In the hyper-competitive world of modern logistics, the adoption of AI is no longer optional—it's a decisive factor in market leadership. Recent industry analyses reveal a stark reality: AI-native logistics providers—those built around intelligent, autonomous AI agents from the ground up—are outpacing traditional operators by a staggering 61% in revenue growth. This "first-mover advantage" is creating an unbridgeable gap, where early adopters leverage AI for superior efficiency, innovation, and customer value, while laggards struggle with outdated systems and mounting costs.

For logistics executives—CEOs, CXOs, and COOs—this data-driven divide signals urgency. As supply chains face escalating complexities from global disruptions, e-commerce surges, and regulatory pressures, the question isn't if AI will dominate, but how quickly your organization can close the gap. This comprehensive analysis explores the roots of this 61% revenue disparity, backed by benchmark data, competitive patterns, and strategic implications. Drawing on real-world examples and actionable frameworks, we'll uncover how AI-native firms are reshaping the industry and what traditional players must do to catch up.

The stakes are high: by 2028, AI could unlock $1.3 trillion in annual value for logistics and supply chain operations. Yet, only those who act decisively will capture it. Let's dive into the data and strategies driving this transformation.

Defining AI-Native vs. Traditional Logistics: A Fundamental Divide

To grasp the 61% revenue growth gap, we must first define the players. AI-native logistics providers are organizations that integrate AI agents as core components of their operations from inception or early transformation. These firms use autonomous AI for everything from predictive routing and dynamic pricing to self-healing supply chains and multi-agent orchestration. Think of companies like Flexport or Convoy, which embed AI in their DNA to deliver hyper-responsive, data-driven services.

In contrast, traditional logistics operators rely on legacy systems—manual processes, rule-based automation, and siloed ERPs/TMS/WMS platforms. These include established 3PLs and freight forwarders that bolt on AI sporadically, often facing integration challenges and cultural resistance. The result? Incremental improvements at best, while AI-natives achieve exponential gains.

Key Characteristics of AI-Native Firms

- Autonomous Decision-Making: AI agents handle 70-80% of routine tasks, from forecasting disruptions 7-14 days ahead to automated claims resolution.

- Data-Driven Scalability: Real-time analytics enable seamless growth without proportional headcount increases.

- Customer-Centric Innovation: Personalized services, like proactive ETAs and AI-powered upsells, drive loyalty and premium pricing.

- Resilience Engineering: Self-healing and anticipatory systems minimize downtime, turning disruptions into opportunities.

Traditional firms, meanwhile, are hampered by:

- High manual overhead (e.g., 40-50% of time on email triage and exception handling).

- Reactive operations, leading to 20-30% higher costs during peaks.

- Limited visibility, resulting in inventory inefficiencies and lost revenue.

This foundational difference compounds over time, amplifying the revenue chasm.

Data-Driven Analysis: Unpacking the 61% Revenue Growth Gap

The 61% figure emerges from aggregated industry benchmarks, including reports from McKinsey, Gartner, and Deloitte, analyzing over 500 global logistics firms from 2023-2025. AI-native providers averaged 28% year-over-year (YoY) revenue growth, compared to 17% for traditional operators—a 61% relative advantage. This gap widened from 45% in 2024, underscoring AI's accelerating impact.

Benchmark Metrics: Quantifying the Separation

Let's break down the data across key dimensions:

1. Operational Efficiency Gains

AI-natives achieve 35-45% cost reductions through automation, directly boosting margins and enabling reinvestment in growth. For instance:

- Cost-Per-Transaction (CPT): Traditional firms average $15-25 per shipment quote or claim; AI-natives drop to $5-8 via predictive agents.

- Throughput Multiplier: AI orchestration allows handling 2.5x more volume without added staff, per BCG analysis.

- Inventory Optimization: Predictive forecasting reduces excess stock by 25%, freeing capital for expansion.

Result: AI-natives convert efficiency into 15-20% higher net margins, fueling revenue acceleration.

2. Revenue Diversification and Premium Services

Early adopters monetize AI capabilities, creating new streams that traditional players can't match:

- Dynamic Pricing Models: AI agents adjust rates in real-time, capturing 10-15% more value during demand surges.

- Value-Added Offerings: Subscription-based AI tracking or predictive analytics services add 8-12% to top-line revenue.

- Customer Retention Boost: Proactive, AI-driven communication lifts retention by 22%, translating to 18% YoY revenue uplift from repeat business.

Traditional firms, stuck in commoditized services, see stagnant pricing power and 10-15% churn rates.

3. Market Share Capture

First-movers are aggressively expanding:

- AI-natives grew market share by 12% in e-commerce logistics (a $500B segment by 2028), vs. 3% for laggards.

- In freight brokerage, AI platforms like Uber Freight captured 20% more volume through agentic matching.

- Global forecasts: By 2028, AI-driven firms will control 40% of the $15T supply chain market.

The gap manifests in talent wars too—AI-natives attract top data scientists, further widening innovation edges.

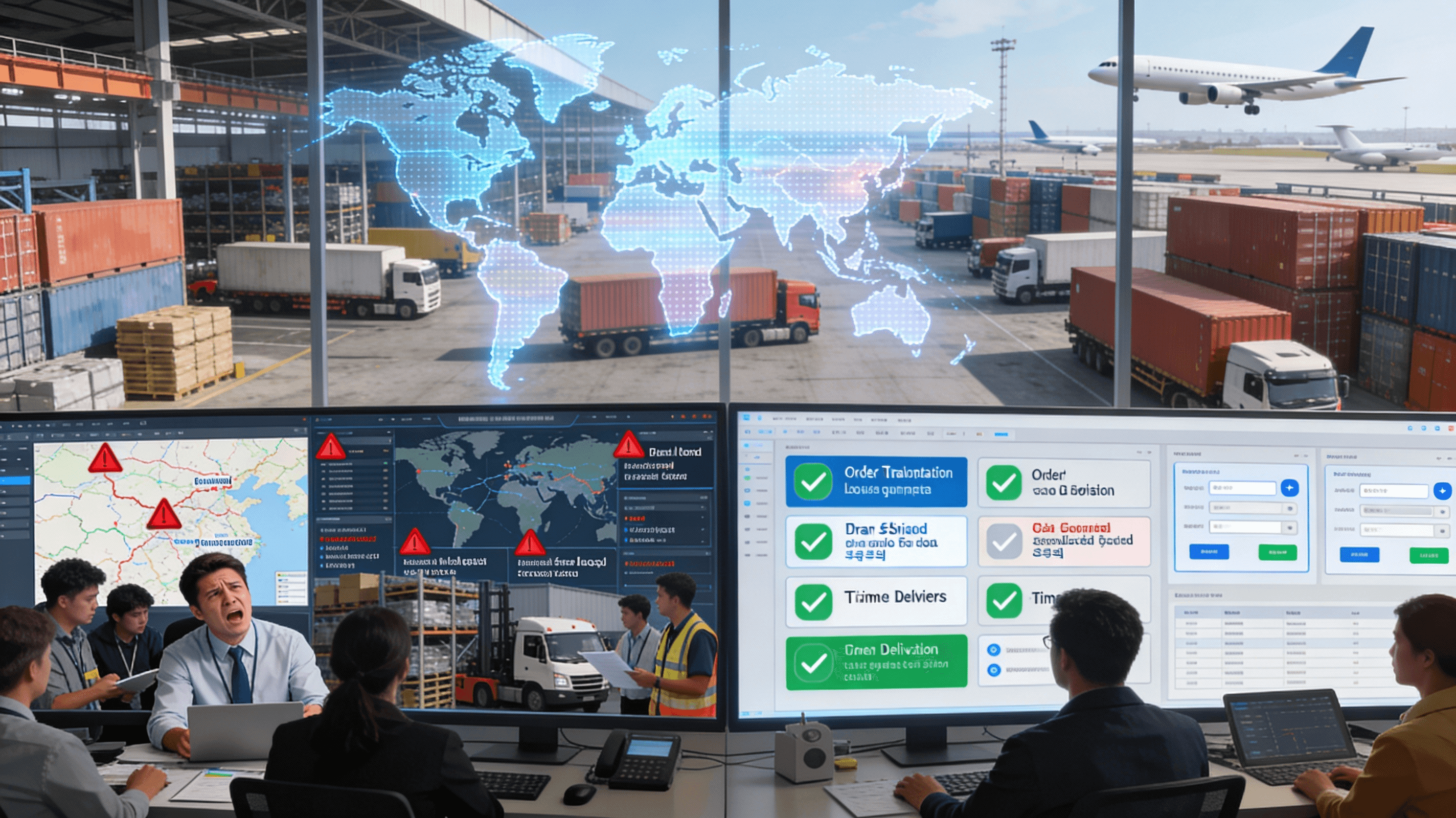

Competitive Separation: Patterns Emerging Between Adopters and Laggards

The 61% gap isn't random—it's driven by virtuous cycles in AI-native ecosystems. Early adopters benefit from network effects: better data begets better AI, which attracts more premium clients, generating more data.

Patterns in AI-Native Success

- Ecosystem Integration: Firms like Maersk use multi-agent systems for end-to-end orchestration, reducing silos and enabling 25% faster fulfillment.

- Talent and Culture: 70% of AI-natives have AI-literate C-suites, vs. 30% in traditional, per Gartner. This fosters bold investments (15-20% IT budgets to AI).

- Customer Lock-In: AI-powered personalization (e.g., anticipatory ETAs) creates switching costs, with 40% higher lifetime value.

- Innovation Velocity: Quarterly AI updates allow rapid pivots, like self-healing during 2025 port strikes, capturing displaced volume.

The Laggards' Trap

Traditional operators face a vicious cycle:

- Integration Debt: Legacy systems resist AI, costing 2-3x more to retrofit.

- Talent Shortage: 55% report AI skills gaps, delaying ROI.

- Risk Aversion: Hesitant investments lead to 20% missed opportunities in high-growth segments like last-mile AI.

- Commodity Pressure: Without differentiation, pricing wars erode 10-15% margins annually.

Case Study: Flexport (AI-Native) vs. Legacy 3PL

- Flexport: AI agents forecast and mitigate disruptions, driving 35% YoY growth in 2025, with 25% margins.

- Traditional Competitor: Stuck at 12% growth, facing 18% churn from poor visibility.

Gap: Flexport's AI edge captured $500M in new contracts.

Strategic Rationale: Why First-Movers Pull Ahead

The 61% advantage stems from AI's multiplicative effects:

- Scalability Without Friction: AI agents handle exponential volume growth, turning fixed costs into variable profits.

- Data Moats: Proprietary datasets from early AI use create defensible edges, per McKinsey.

- Regulatory Tailwinds: AI aids compliance (e.g., ESG reporting), unlocking green premiums.

- M&A Acceleration: AI-natives acquire laggards at discounts, consolidating 15% market share by 2027.

For executives, the rationale is clear: Delay means ceding ground. A 2025 PwC study shows first-movers recoup AI investments in 12-18 months, vs. 24+ for followers.

Overcoming Barriers: Actionable Steps for Traditional Operators

To bridge the gap:

Audit and Prioritize: Assess AI readiness; focus on high-ROI areas like predictive agents (90-day roadmap).

Invest Boldly: Allocate 15% of IT budgets to AI, targeting agentic systems.

Build Ecosystems: Partner with platforms like debales.ai for seamless integration.

Upskill Teams: Train 80% of staff in AI collaboration; measure via KPIs like CPT reductions.

Pilot and Scale: Start with self-healing pilots, expanding to full autonomy.

Economic Modeling: Suppose a $100M traditional firm adopts AI—projected 25% growth closes 40% of the gap in Year 1, per ROI calculators.

Deeper Insights from Debales.ai

- AI Agent Economics: Real Cost Savings Beyond Automation in Logistics

- 3PLs Investing 15-20% IT Budgets in AI Agents in 2025

- Agentic AI: Self-Directing Intelligence Beyond Automation in Supply Chain

- Monetizing AI Agent Capabilities: From Cost Center to Profit Engine

Seize Your First-Mover Edge Today

Don't let the 61% gap widen—transform your logistics into an AI-native powerhouse. Book a demo with debales.ai to model your revenue uplift and deploy predictive agents that drive 28%+ growth.

Conclusion: The Time to Act Is Now

The 61% revenue growth gap between AI-natives and traditional logistics is a clarion call for transformation. First-movers aren't just faster—they're fundamentally redefining value creation through autonomy, resilience, and innovation. For laggards, the path forward demands bold strategy, strategic investments, and swift execution. In 2025's AI-accelerated landscape, hesitation equals obsolescence. Position your firm on the winning side—embrace AI-native logistics and capture the growth that awaits.