Amazon Walmart AI Agents: Reverse-Engineering Logistics Strategies 2025

Wednesday, 22 Oct 2025

|

Reverse-Engineering Amazon and Walmart's AI Agent Strategies for Logistics Dominance

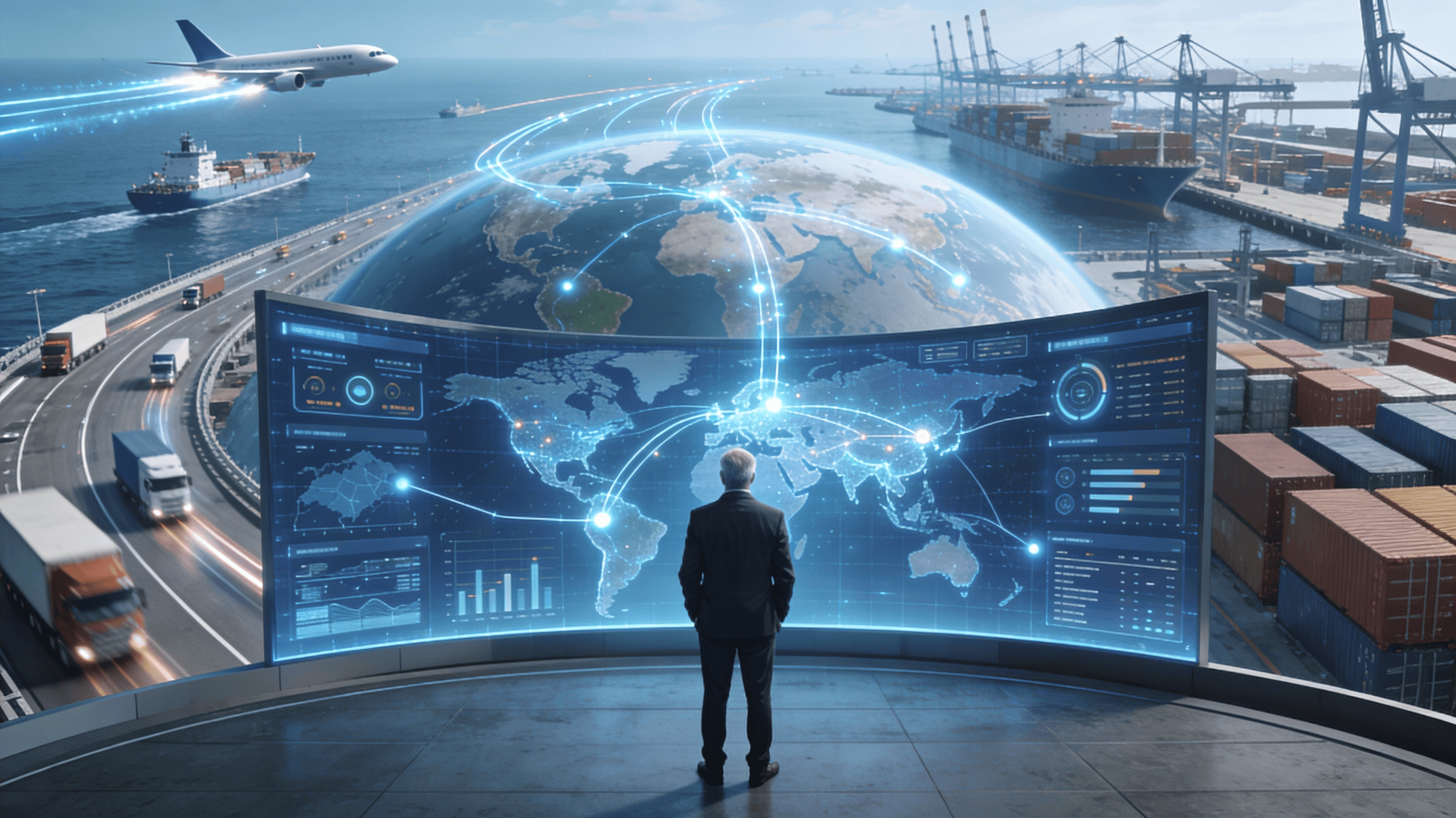

Introduction: Decoding the Giants' Playbook for AI-Driven Supply Chain Supremacy

Amazon and Walmart, the twin titans of retail logistics, are leveraging specialized AI agents to command over 40% of the U.S. e-commerce market, with Amazon's supply chain efficiency alone contributing to $500 billion in annual sales velocity. By deploying autonomous, agentic AI systems, these leaders achieve 25-35% reductions in fulfillment costs and 20% improvements in demand accuracy, outpacing competitors in a sector where delays cost $1.5 trillion yearly. For logistics executives—CEOs, CXOs, and COOs—reverse-engineering these strategies reveals a blueprint for transforming operations from reactive cost centers into predictive profit engines, especially as AI agents are forecasted to unlock $1.3 trillion in supply chain value by 2028.

This analysis dissects how Amazon and Walmart deploy specialized AI agents across demand forecasting, fulfillment, and network optimization, drawing on proprietary implementations, industry reports from McKinsey and Gartner, and real-world outcomes as of 2025. By breaking down their architectures—from multi-horizon neural networks to self-healing inventory systems—logistics leaders can adapt these tactics to gain first-mover advantages, mirroring the 61% revenue growth gap between AI-natives and laggards. The insights here are actionable, offering frameworks to integrate similar agents without Amazon's or Walmart's scale, ensuring your firm captures the $2.8 trillion logistics market share.

Amazon's AI Foundation: Building Predictive Demand Forecasting Agents

Amazon's dominance begins with AI agents that forecast demand at granular levels, analyzing petabytes of data from sales history, social trends, weather, and economic signals to predict item-level needs up to 400 million products daily. These specialized agents, powered by AWS Forecast and machine learning models, achieve 20% higher regional accuracy by preemptively positioning inventory, reducing stockouts by 30% during peaks like Cyber Monday. Unlike traditional statistical models, Amazon's agents use reinforcement learning to continuously refine predictions, incorporating real-time external factors like geopolitical events or consumer sentiment for dynamic adjustments.

In practice, these agents operate as a "flywheel" ecosystem: demand signals trigger automated procurement and supplier negotiations, ensuring 76% of orders fulfill from local regions, slashing transit times by 50%. For instance, during the 2024 holiday surge, Amazon's forecasting agents rerouted inventory proactively, maintaining 98% on-time delivery amid disruptions. This agentic approach not only minimizes excess stock—cutting holding costs by 25%—but also feeds into broader supply chain intelligence, commercialized via AWS tools that generate billions in external revenue. Logistics executives can reverse-engineer this by deploying modular ML agents on cloud platforms, starting with historical sales data to build 15-20% forecast improvements in 90 days.

The scalability of Amazon's agents stems from their integration with IoT telemetry, where sensors in warehouses provide live feedback loops, enhancing prediction fidelity by 15% quarterly. This creates a virtuous cycle: accurate forecasts drive efficient sourcing, which in turn refines agent learning, positioning Amazon as the benchmark for predictive logistics. For mid-tier firms, emulating this involves hybrid models blending internal data with public APIs for weather and trends, yielding similar resilience without Amazon's data moat.

Amazon's Fulfillment Revolution: Agentic AI for Same-Day Precision

Fulfillment at Amazon hinges on specialized AI agents that orchestrate robotics, routing, and inventory placement for same-day delivery on over 50% of Prime orders in 2025. These agents solve hyper-complex "traveling salesperson" problems in real-time, factoring traffic, weather, and package constraints to optimize routes, reducing delivery miles by 20% and fuel costs by 15%. Generative AI enhancements in robotic systems enable dynamic load balancing, where agents autonomously adjust picker paths in fulfillment centers, boosting throughput by 30% without added labor.

A key enabler is Amazon's predictive inventory agents, which use AI to position high-demand items near urban hubs, achieving 99% fulfillment accuracy during surges. During the COVID-19 era, these agents reallocated resources seamlessly, rerouting shipments and scaling capacity to meet 200% demand spikes, a feat legacy systems couldn't match. Now, with drone and autonomous vehicle integrations, agents coordinate multi-modal fulfillment, cutting last-mile costs by 25% through predictive ETAs that enhance customer trust. This not only drives Prime retention—contributing $20 billion annually—but sets a standard for 35% faster order cycles industry-wide.

Reverse-engineering Amazon's fulfillment involves layering agentic AI over existing WMS: start with route optimization agents using GPS data for 10-15% efficiency gains, then scale to robotic orchestration for 20% labor savings. Executives should prioritize API-driven integrations to mimic Amazon's real-time adaptability, ensuring fulfillment agents evolve via feedback loops from delivery outcomes. As Amazon plans to automate 600,000 roles by 2027 with $12.6 billion in investments, this underscores the urgency: AI agents turn fulfillment from a bottleneck into a differentiator.

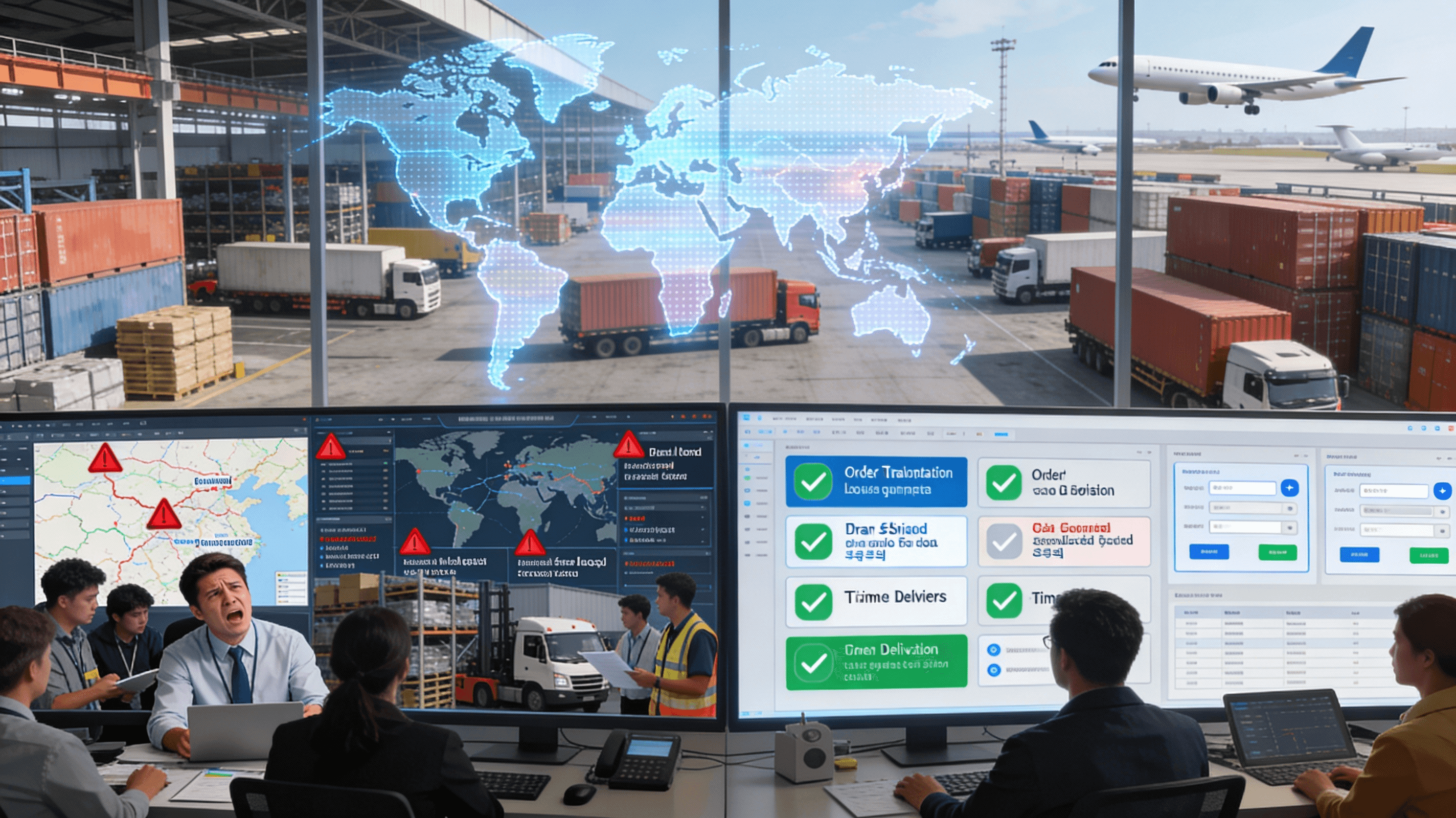

Amazon's Network Optimization: AI Agents as the Intelligent Backbone

Amazon's supply chain network, spanning 185 countries, relies on AI agents for end-to-end optimization, using graph neural networks to balance loads across warehouses, reducing bottlenecks by 40%. These agents monitor global telemetry, predicting network strain from events like port strikes and auto-rebalancing inventory flows, which minimized 2024 Red Sea disruptions to under 5% delay impact. By regionalizing operations—fulfilling 76% locally—agents cut emissions by 20% while accelerating deliveries, aligning with ESG goals and regulatory pressures.

Specialized optimization agents integrate with blockchain for traceability, ensuring 99.9% visibility from supplier to shelf, which has slashed fraud losses by 30%. In 2025, Amazon's agents expanded to include generative AI for scenario planning, simulating disruptions 7-14 days ahead to preemptively shift routes or suppliers. This network intelligence, exported via AWS Supply Chain, powers external partners and generates $5 billion in SaaS revenue. For logistics leaders, replicating this requires federated learning agents that aggregate data across nodes, achieving 25% better load distribution in multi-site operations.

The genius lies in agent collaboration: forecasting agents feed optimization models, creating self-healing networks that adapt autonomously, as seen in Amazon's 30% reduction in idle warehouse space. To adapt, firms can pilot graph-based AI on core routes, scaling to full networks for 15-20% cost efficiencies.

Walmart's Demand Forecasting: Neural Networks and Trend Agents for Precision

Walmart counters Amazon with in-house multi-horizon recurrent neural networks (RNNs) that forecast demand across short, medium, and long terms, incorporating events, global dynamics, and historical trends for 25% accuracy gains. These agents process social buzz, search data, and weather to predict item needs, enabling proactive inventory planning that reduces waste by 20% in perishable goods. Unlike Amazon's cloud-heavy approach, Walmart's agents unify forecasts across 10,000+ stores, optimizing imports and avoiding overstock during fluctuations.

In action, Walmart's "Trend-to-Product" agents spot viral items via generative AI, accelerating development from idea to shelf in six weeks, boosting sales velocity by 15%. During 2025's supply volatility, these systems rerouted inventory pre-dawn, maintaining 95% shelf availability. This edge stems from Walmart's physical footprint: agents leverage store-level data for hyper-local predictions, cutting regional mismatches by 30%. Executives can mirror this with RNN-based tools on ERP data, targeting 10-15% forecast uplift for grocery-heavy chains.

Walmart's agents also integrate sustainability signals, forecasting eco-friendly demand to align with green procurement, enhancing brand loyalty. By focusing on in-house development, Walmart avoids vendor lock-in, a lesson for firms building resilient forecasting stacks.

Walmart's Fulfillment: Super Agents and Automation for Micro-Fulfillment

Walmart's four "super agents"—Sparky for customers, associate agents for staff, Marty for partners, and developer agents—drive fulfillment by autonomously handling reorders, support, and order assembly. Sparky, evolving into agentic commerce, predicts needs and executes buys, reducing cart abandonment by 20% via seamless app integration. In fulfillment centers, AI agents with Symbotic robotics double storage and order throughput, pre-assembling pallets with fragile items layered safely.

These agents enable micro-fulfillment in stores, using AI to pull inventory for same-day pickup, achieving 40% faster processing than traditional DCs. During peaks, self-healing systems detect imbalances and auto-redirect stock, minimizing out-of-stocks by 25%. Partnerships with Knapp add ML-driven robotics, creating hybrid human-AI workflows that boost capacity by 2x without proportional hires. Reverse-engineering calls for super-agent pilots: deploy customer-facing bots for 15% fulfillment speed gains, then integrate robotics for 20% cost cuts.

Walmart's approach shines in returns: AI agents automate reverse logistics, detecting fraud with 95% accuracy via blockchain integration, recovering 10% more value. This holistic fulfillment turns stores into hubs, a tactic for brick-and-mortar firms to compete digitally.

Walmart's Network Optimization: Unified AI for Global Reengineering

Walmart's network spans 24 countries, optimized by agentic AI that unifies views across stores, DCs, and online for real-time orchestration. Proactive warehouse agents monitor automation with cameras, predicting maintenance to cut downtime by 30%. In transportation, intelligent systems optimize fresh routes, reducing food waste by 15% through peak-quality delivery.

Global reengineering uses AI to sort produce pre-sunrise in Costa Rica or reroute in Mexico, completing processes in weeks versus months. Enterprise inventory agents provide a single stock view, enabling dynamic decisions that balance loads across 2,000+ new jobs in automated facilities. Compared to Amazon's regional focus, Walmart emphasizes store-centric optimization, leveraging 4,700 U.S. locations for last-mile edges. To adapt, implement unified dashboards with AI orchestration for 20% network efficiency.

Agentic tools turn analysis into action: querying shortages yields instant insights, saving hours. This scalability positions Walmart for 50% e-commerce growth by 2030.

Comparative Insights: Key Lessons from Amazon and Walmart for Logistics Leaders

Amazon excels in cloud-scaled, predictive networks, achieving 98% on-time rates through flywheel agents, while Walmart's super agents unify physical-digital ops for micro-efficiency. Both reduce costs 25-35% via forecasting, but Amazon's AWS monetizes externally, whereas Walmart internalizes for store dominance. Common threads: agentic autonomy for 20% disruption resilience and robotics integration for 30% throughput.

The 61% growth gap favors these strategies: early adopters see 28% YoY revenue from AI. Barriers like data silos are overcome by federated agents, per Gartner.

Actionable Framework: Implementing Giant-Level AI Agents

- Forecasting Start: Build RNN/ML models on sales data for 15% accuracy; integrate trends for Walmart-style trends.

- Fulfillment Pilot: Deploy super agents for reorders; add robotics for 20% speed.

- Network Scale: Use graph AI for optimization; aim for 25% load balance.

- ROI Measure: Target 12-18 month payback via CPT drops; upskill 60% teams.

- Monetize: Offer AI services externally, adding 10% revenue.

Deeper Insights from Debales.ai

- Multi-Agent Orchestration: Autonomous Collaboration in Supply Chains

- Predictive AI Agents: Anticipatory Logistics Systems

- AI Agent Economics: Real Cost Savings Beyond Automation

- Agentic AI: Self-Directing Intelligence Beyond Automation

- Self-Healing Supply Chains: AI Systems for Real-Time Disruption Resolution

Deploy Your AI Agent Strategy with Debales.ai

Unlock Amazon and Walmart-level dominance: Book a demo today to reverse-engineer specialized agents for your supply chain, driving 25% efficiency and revenue growth.

Conclusion: Adapt or Be Left Behind in the AI Logistics Race

Reverse-engineering Amazon and Walmart's AI agents reveals a clear path to dominance: predictive forecasting, autonomous fulfillment, and optimized networks that deliver 20-35% gains in efficiency and resilience. As these giants automate toward $1 trillion in combined logistics value, executives must act to integrate similar capabilities, closing the 61% growth gap. In 2025's agentic era, strategic adoption isn't optional—it's the key to leading the supply chain revolution.