Cloud-First AI Agents: SaaS Deployment Without Infrastructure Overhaul

Tuesday, 28 Oct 2025

|

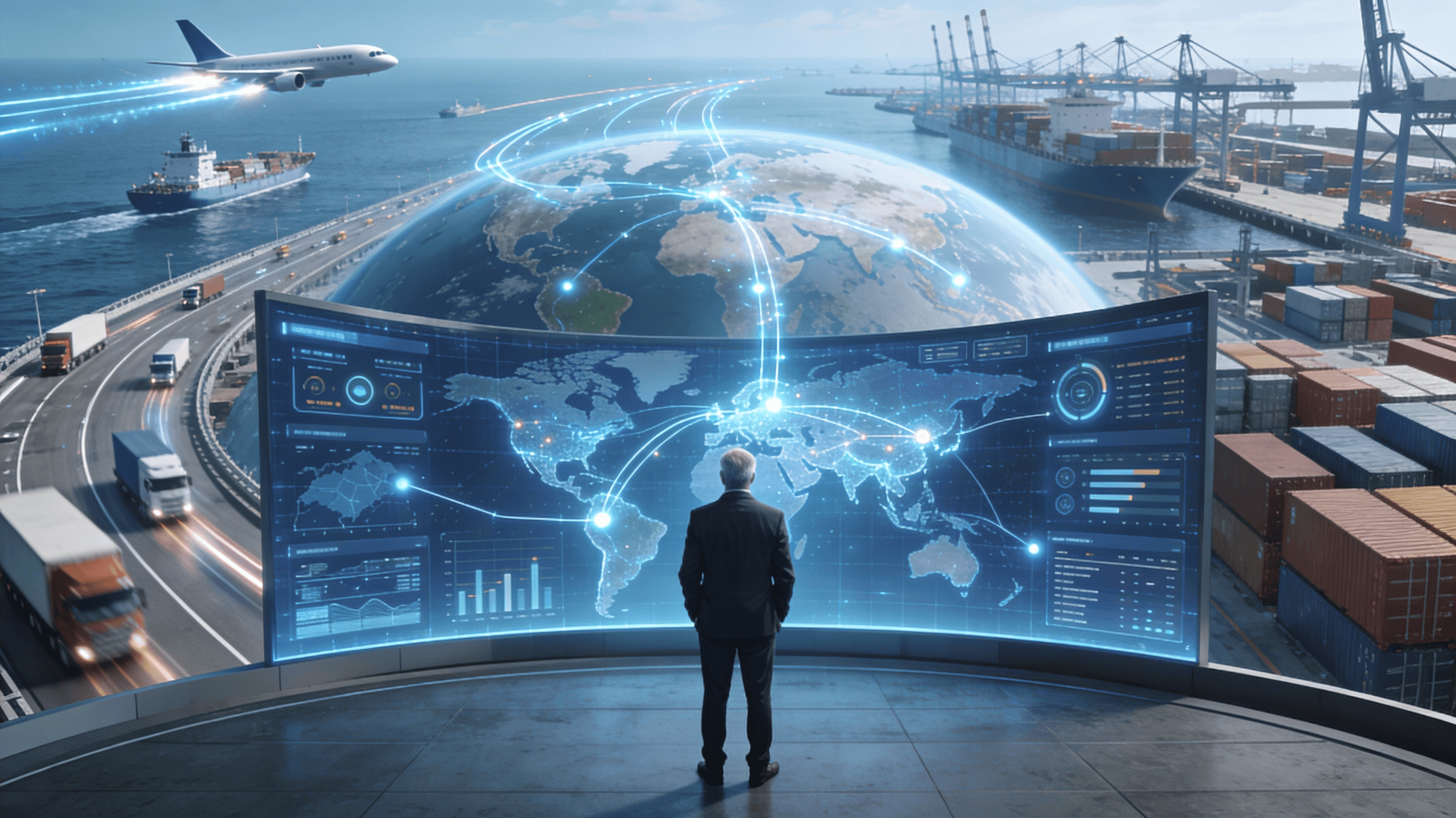

Introduction: Empowering Logistics with SaaS-Driven AI Agents

Traditional on-premise AI deployments demand significant upfront investments in hardware, servers, and IT expertise, often exceeding $500,000 for initial setups in mid-sized logistics firms and delaying ROI by 12-18 months. Cloud-first AI agent deployment via SaaS platforms circumvents these barriers, enabling rapid scaling of intelligent operations without infrastructure overhauls, achieving deployment in weeks and cost reductions of up to 70% through subscription models. These strategies leverage multi-tenant cloud architectures to host autonomous agents for tasks like route optimization, inventory prediction, and compliance monitoring, integrating seamlessly with existing TMS and WMS via APIs.

For CTOs, CIOs, and supply chain executives in logistics, this approach democratizes AI adoption, allowing even SMBs to access enterprise-grade intelligence that boosts efficiency by 40% and adaptability in volatile markets. This guide details SaaS implementation strategies, from vendor selection to hybrid integrations, providing actionable steps, best practices, and ROI frameworks to accelerate deployment while maintaining data sovereignty and compliance. As logistics faces 25% annual growth in e-commerce demands, cloud-first strategies position organizations to scale intelligence proactively, avoiding the pitfalls of legacy on-prem constraints.

The Pitfalls of On-Premise AI: Why Cloud-First is Essential

On-premise AI installations require dedicated data centers, cooling systems, and specialized teams, leading to scalability bottlenecks where adding agents means hardware upgrades costing 2-3x initial investments annually. These setups also introduce maintenance burdens, with downtime risks up to 5% higher than cloud alternatives due to firmware updates and power failures, disrupting critical logistics workflows like real-time tracking. Moreover, on-prem models lock firms into static configurations, making it challenging to incorporate emerging AI advancements like multimodal LLMs without full migrations.

In contrast, SaaS-based cloud platforms offer elastic scaling, where agents auto-provision resources during peak seasons—handling 10x shipment volumes without manual intervention—and pay-as-you-go pricing that aligns costs with usage. Security is enhanced through provider-managed compliance (e.g., SOC 2, GDPR), reducing internal audit overhead by 50%, while global edge networks minimize latency for time-sensitive applications like last-mile routing. For logistics, this means deploying predictive agents for freight fraud detection in days, not months, without overhauling existing infrastructure.

Core SaaS Implementation Strategies for AI Agents

SaaS strategies prioritize low-code/no-code platforms that abstract complexity, allowing non-technical users to configure agents via drag-and-drop interfaces for logistics-specific workflows like demand forecasting. Key approaches include multi-tenant architectures for shared resource efficiency and serverless computing to execute agent tasks on-demand, eliminating idle server costs. Integration-first platforms like those using Zapier or native APIs ensure agents pull data from legacy systems, transforming siloed TMS outputs into actionable insights without custom coding.

Vendor selection focuses on logistics-tuned SaaS: Evaluate for pre-built agents (e.g., for WMS inventory optimization), uptime SLAs exceeding 99.9%, and extensibility via custom plugins. Hybrid models blend public cloud for core AI with private edges for sensitive data, balancing cost and control in regulated supply chains. Implementation begins with pilot deployments—starting with a single agent for email triage—scaling based on KPIs like response time reductions.

Strategy 1: Rapid Onboarding and Configuration

Leverage SaaS dashboards for zero-touch onboarding, where agents auto-discover connected systems via OAuth and configure rules using natural language prompts, such as "Optimize routes for fuel efficiency under $5/gallon". This avoids on-prem's lengthy installations, enabling go-live in 2-4 weeks versus 6 months. Use modular agent marketplaces to mix-and-match capabilities, like combining a forecasting agent with a compliance checker for end-to-end automation.

Testing in sandbox environments simulates logistics scenarios—e.g., port delays—without risking production data, ensuring 95% accuracy before full rollout. Ongoing configuration via web consoles allows iterative refinements, adapting agents to seasonal demands without IT tickets.

Strategy 2: Seamless Integrations and Data Flows

SaaS platforms excel with pre-built connectors for TMS (e.g., Oracle), WMS (e.g., Manhattan), and ERP (e.g., SAP), using event-driven webhooks to trigger agents on data changes like new shipments. For legacy systems, middleware like MuleSoft orchestrates bidirectional flows, converting EDI to JSON for AI ingestion while pushing optimized decisions back. Real-time data pipelines via Kafka ensure agents access streaming telematics, enabling predictive maintenance without batch processing delays.

Data governance is simplified with built-in anonymization and versioning, supporting federated learning where agents train on aggregated data without exposing proprietary logistics info. This strategy scales to multi-agent swarms, where orchestration layers coordinate tasks across clouds for global visibility.

Strategy 3: Scaling and Performance Management

Elastic scaling in SaaS auto-adjusts compute for agent loads, supporting 1000+ concurrent simulations during Black Friday without overprovisioning. Monitoring tools provide AI-driven alerts on anomalies, like agent drift in demand predictions, with auto-remediation to maintain 98% uptime. Cost optimization uses reserved instances for baseline agents and spot pricing for bursty tasks like route replanning.

For logistics, this means handling volume spikes—e.g., 50% order surges—with minimal latency, while analytics dashboards track ROI metrics like cost per agent invocation. Future-proofing involves API versioning to upgrade agents seamlessly, incorporating new models without downtime.

Overcoming Common Challenges in Cloud-First Deployment

Data privacy concerns are addressed through SaaS providers' zero-trust architectures and client-side encryption, ensuring logistics-sensitive info like shipment manifests remains secure. Vendor lock-in is mitigated by open standards like OpenAPI, allowing agent portability across platforms. Skill gaps are bridged with SaaS training modules and community forums tailored to logistics use cases.

Latency for global operations is minimized via CDNs and regional data centers, critical for real-time freight quoting. Regulatory hurdles, such as customs compliance, are handled by compliant SaaS tiers with audit logs and export controls. By starting small and iterating, firms avoid big-bang failures common in on-prem projects.

ROI Framework: Quantifying Cloud-First Value

SaaS deployments deliver 4-6x ROI within 6-9 months, with initial costs under $50,000 versus $300,000+ for on-prem, through opex models that defer capex. Savings accrue from 60% lower TCO via managed services and 35% faster time-to-value, enabling quicker wins like 25% reduction in idle fleet time. Revenue uplifts include 20% higher on-time deliveries via predictive agents, directly boosting customer retention.

Calculate ROI as: (Efficiency Gains + Revenue Increase - SaaS Fees) / SaaS Fees. For a 500-truck fleet, this yields $1.2M annual savings from optimized routing alone. Case studies: A 3PL using SaaS AI scaled agents across 10 sites, cutting integration costs by 75% and achieving 40% throughput gains. Another forwarder deployed cloud agents for compliance, reducing fines by $500K yearly.

Roadmap: From Evaluation to Enterprise-Scale Deployment

Phase 1 (Weeks 1-2): Assess needs via SaaS PoCs, selecting platforms with logistics templates. Phase 2 (Weeks 3-6): Onboard core agents, integrating with 1-2 systems and piloting workflows. Phase 3 (Months 2-3): Scale to full operations, monitoring KPIs and optimizing configurations. Phase 4 (Ongoing): Expand with advanced agents, leveraging updates for continuous improvement.

Budget 10-15% of IT spend initially, focusing on high-ROI areas like automation. Partner with SaaS experts for guided migrations, ensuring alignment with logistics goals.

Explore More on Debales.ai

- 90-Day AI Agent Roadmap: Fast-Track Supply Chain Value

- AI Agent Economics: Real Cost Savings Beyond Automation in Logistics

- Beyond ERP: AI Agents Supply Chain Automation

- Multi-Agent Orchestration: Autonomous Collaboration in Supply Chains

- Agentic AI: Self-Directing Intelligence Beyond Automation in Supply Chain

Deploy Cloud-First AI Agents Effortlessly

Revolutionize your logistics with SaaS AI agents that scale without the hassle. Contact Debales.ai for a free deployment assessment.

Start Your Cloud AI Journey Today

Conclusion: Scaling Intelligence in the Cloud Era

Cloud-first AI agent deployment via SaaS strategies eliminates on-premise barriers, enabling logistics firms to scale intelligently, reduce costs, and accelerate innovation without infrastructure overhauls. By embracing these approaches, executives can unlock autonomous operations that drive resilience and growth in a competitive landscape. The future of supply chain intelligence is cloud-native—deploy it now to stay ahead.