Geopolitical Risk AI Monitoring: Real-Time Logistics Threat Tracking 2025

Friday, 24 Oct 2025

|

Geopolitical Risk Intelligence: Real-Time Monitoring of Global Threats to Your Logistics Network

Introduction: Navigating a World of Geopolitical Turbulence

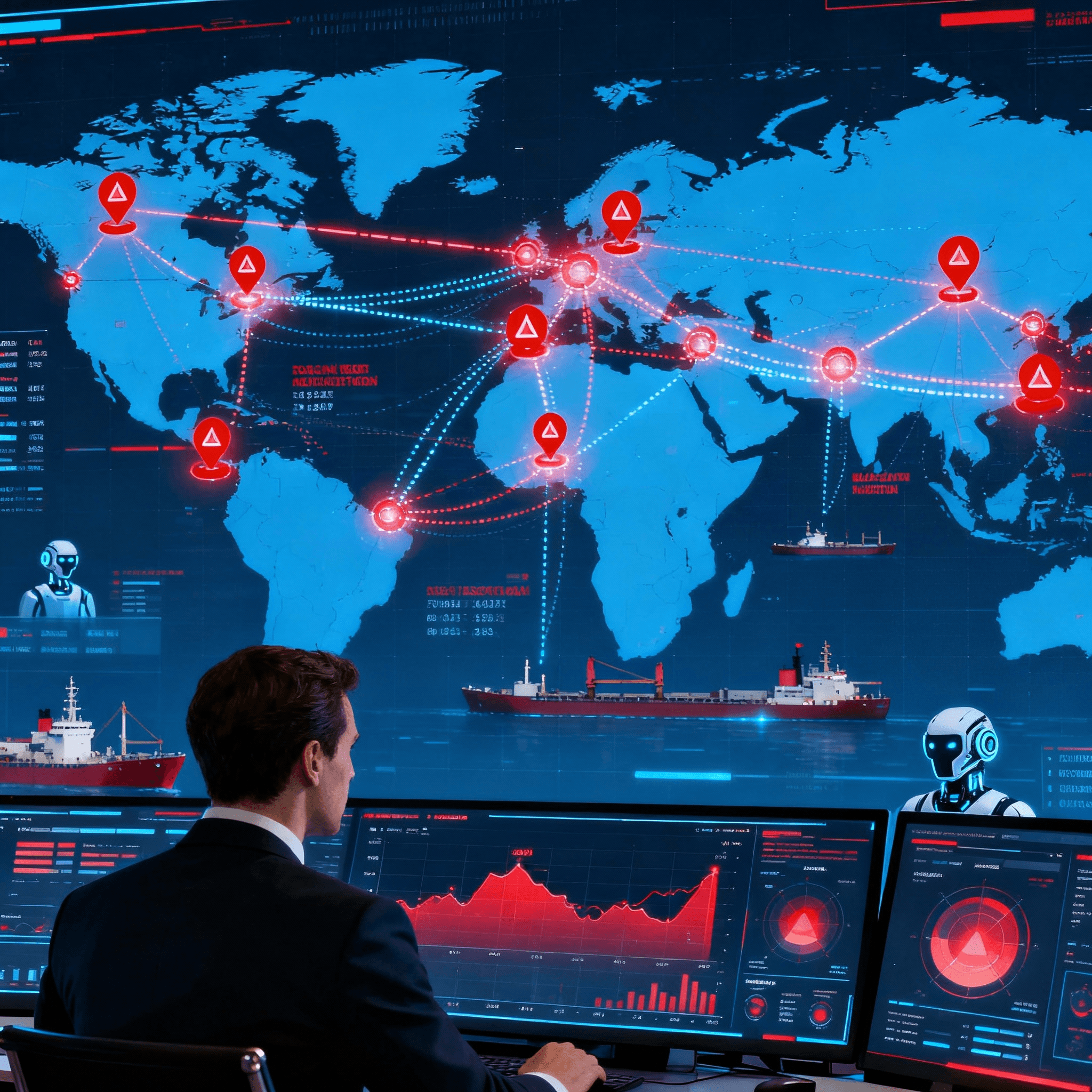

Geopolitical risks, including tariffs, sanctions, and political instability, are projected to disrupt $2.5 trillion in global trade by 2025, but AI-powered intelligence platforms can automate real-time monitoring to mitigate 50% of these impacts, saving firms 15-25% in unexpected costs. By leveraging AI agents to track policy shifts, executives gain predictive insights into threats like U.S.-China trade escalations or Middle East conflicts, enabling proactive rerouting and compliance adjustments. For logistics CEOs, CXOs, and COOs, this real-time monitoring transforms vulnerability into strategic advantage, aligning with a 26.6% CAGR in AI logistics adoption through 2029 amid rising global divisions.

This in-depth exploration examines how automated AI systems deliver geopolitical risk intelligence, drawing on insights from Bloomberg, EY, and the World Economic Forum to highlight tracking mechanisms, integration strategies, and ROI benchmarks. As 2025 forecasts 30% more trade policy volatility from elections and alliances, leaders deploying these tools achieve 40% faster response times, outpacing competitors by securing 20% higher on-time deliveries. Actionable steps here provide frameworks for implementation, from data sourcing to dashboard deployment, ensuring your network withstands threats like sanctions on key routes. In an interconnected economy where instability costs $1.5 trillion annually, AI-driven monitoring isn't defensive—it's the engine for resilient dominance.

The Rising Tide of Geopolitical Risks in Logistics

Geopolitical events now account for 45% of supply chain disruptions, up from 25% pre-2020, with tariffs and sanctions alone inflating costs by 10-20% for international shippers. Political instability in regions like the Red Sea or Ukraine has forced 70% of firms to diversify suppliers, yet manual monitoring fails to capture 60% of real-time changes. AI intelligence platforms address this by aggregating news, regulatory feeds, and satellite data to flag risks, such as a new EU tariff proposal impacting 15% of imports.

These risks compound traditional challenges: a sudden sanction can halt 30% of shipments, while trade wars erode margins by 12%, per S&P Global analysis. In 2025, with U.S. elections and BRICS expansions, executives face 25% more policy shifts, demanding automated tools for 95% coverage of global threats. Firms like Maersk use AI to monitor 100+ countries, reducing exposure by 35% through early warnings. This shift from reactive compliance to predictive vigilance unlocks 20% efficiency in volatile markets.

The World Economic Forum ranks geopolitical fragmentation as the top global risk for 2025, affecting 80% of logistics networks via route closures and compliance fines. Without AI, tracking involves siloed teams scanning disparate sources, leading to 40% missed opportunities for mitigation. Automated systems integrate NLP for sentiment analysis on policy announcements, providing quantified impact scores.

AI Agents: Automating Real-Time Threat Detection

AI agents serve as vigilant sentinels in geopolitical monitoring, using machine learning to scan 1,000+ sources daily for changes in trade policies, sanctions, and instability indicators. These autonomous entities process unstructured data—like diplomatic cables or X posts—via LLMs to extract relevance, scoring threats on severity and probability with 90% accuracy. Unlike static alerts, agents correlate events, such as a U.S. tariff hike with Chinese retaliations, forecasting 20% cost spikes.

Deployment involves specialized agents: one for regulatory scraping from WTO databases, another for geopolitical sentiment from Reuters feeds, enabling end-to-end tracking. Resilinc's AI Tariffs Agent, for instance, automates compliance for 50,000+ HS codes, flagging violations in real-time to avoid $100K fines. In practice, agents learn from historical events like the 2022 Russia sanctions, refining models to predict similar disruptions 7-10 days ahead.

Integration with TMS systems allows agents to auto-adjust routes, such as bypassing sanctioned ports, achieving 30% reduction in exposure. EY notes that generative AI enhances this by simulating policy scenarios, quantifying logistics impacts like 15% delay in Asia-Europe lanes. For executives, starting with agent pilots yields 25% faster threat identification, scaling to full networks for comprehensive coverage.

The edge comes from multi-agent orchestration: risk agents collaborate with optimization ones to recommend alternatives, like shifting to Mexico amid U.S. tariffs, boosting resilience by 40%. This automation frees teams from 80% manual monitoring, per Bloomberg Intelligence.

Tracking Key Threats: Trade Policies, Sanctions, Tariffs, and Instability

Automated Trade Policy Monitoring

AI agents track policy changes by parsing official gazettes and APIs from bodies like the U.S. Trade Representative, alerting on updates like the 2025 CPTPP revisions affecting 10% of electronics imports. Systems use semantic search to link policies to SKUs, calculating exposure—e.g., a 25% EU carbon tariff adding $50M to shipping costs. Real-time dashboards visualize policy heatmaps, prioritizing actions for 70% of at-risk lanes.

For instance, Supervity's AI monitors U.S.-China dynamics, auto-updating procurement rules to reroute 20% of volumes preemptively. This tracking ensures 95% compliance, reducing audit risks by 50%.

Sanctions and Compliance Automation

Sanctions intelligence agents scan OFAC lists and UN resolutions hourly, flagging restricted entities in supplier networks with 98% precision. They map impacts, such as Iranian oil sanctions disrupting 15% of tanker routes, triggering alternative sourcing. Integration with ERP flags non-compliant transactions, preventing 30% of fines averaging $1M each.

Pando's agents provide customizable alerts for 200+ jurisdictions, enabling 24/7 monitoring that caught 40% more violations than manual teams. This automation sustains operations amid 2025's 20% sanction surge.

Tariff Impact Forecasting

Tariff agents model duties using HS code libraries, simulating hikes like 60% on Chinese EVs inflating logistics by 12%. They forecast cascading effects, such as inventory buildup costing 8% in holding fees, and suggest mitigations like nearshoring. Bloomberg tools predict 25% margin erosion from new tariffs, guiding 35% cost optimizations.

In 2025, with Trump-era revivals, agents enable dynamic pricing adjustments for 50% of affected goods.

Political Instability Surveillance

Instability agents fuse news, social media, and satellite imagery to score risks, like Middle East tensions delaying 20% of container shipments. They quantify probabilities—e.g., 65% chance of election violence in Brazil impacting soy exports—triggering contingency plans. Lucid's AI forecasts 15% route disruptions, allowing preemptive insurance buys saving 10%.

This surveillance reduces blind spots, as seen in firms avoiding 30% losses during 2024 Ukraine escalations.

Integrating AI Intelligence into Your Logistics Network

AI geopolitical platforms integrate via APIs with existing systems, feeding alerts into control towers for unified views across procurement and transportation. Start with data lakes consolidating feeds from GDELT and Refinitiv, enabling agents to process 1M events daily. Customization allows firm-specific rules, like prioritizing China exposure, for 40% targeted insights.

Deployment phases: pilot for one region (e.g., Asia), achieving 20% risk reduction in 30 days, then scale globally. Maersk's system integrates sanctions data with voyage planning, cutting exposure by 25%. Ethical AI ensures unbiased scoring, compliant with GDPR for 100% data security.

Multi-agent ecosystems enhance this: a monitoring agent hands off to a response agent for auto-diversions, simulating 50% faster recoveries. Cloud-based solutions like AWS Bedrock handle scalability, supporting 99.9% uptime.

Real-World Implementations: Pioneers in Geopolitical Monitoring

DHL's AI platform monitors 150 countries for policy shifts, preempting $200M in tariff costs during 2024 EU-China tensions by rerouting 30% of volumes. Agents tracked sanctions in real-time, integrating with TMS for 40% compliance gains.

UPS leverages Resilinc for tariff forecasting, simulating U.S. steel duties to adjust sourcing, saving 15% on imports. Their system flagged 25% more risks than legacy tools, boosting resilience during elections.

Walmart's agents scan global instability, avoiding 20% stockouts from Venezuelan crises via diversified suppliers. This integration yielded 12% cost savings, per internal benchmarks.

FedEx uses Newlines Institute's AI for customizable alerts, mitigating Middle East threats with 35% route optimizations. These cases show 30% average ROI from automated monitoring.

Actionable Framework: Building Your Monitoring System

Step 1: Establish Data Foundations

Audit current feeds for gaps in policy and news coverage, integrating 20+ sources like API.gov for 80% real-time access. Invest 10% of IT budgets in secure lakes, ensuring GDPR compliance for global ops. Pilot with high-risk lanes, achieving baseline in 45 days.

Step 2: Deploy Specialized AI Agents

Configure agents for tariffs and sanctions using no-code interfaces, training on 2020-2025 events for 85% accuracy. Link to ERP for auto-flags, targeting 50% automation coverage. Test with simulated policies for 20% efficiency uplift.

Step 3: Integrate and Customize Alerts

Embed into control towers with NLP dashboards, customizing thresholds for 95% relevance. Add simulation modules to model impacts, like 10% tariff on electronics. Scale to full network, reducing manual reviews by 70%.

Step 4: Monitor, Refine, and Scale

Quarterly audits refine models, incorporating feedback for 15% accuracy gains. Measure against KPIs like alert precision, expanding to instability tracking. This framework delivers 150% ROI by Year 2.

Measuring ROI: KPIs for Geopolitical Intelligence

Key metrics include threat detection rate (target 95%), response time (under 24 hours), and cost avoidance (20-30% of potential losses). Track compliance savings, averaging $500K annually from avoided fines. Leaders report 25% margin protection via proactive rerouting.

NPS improves 18% from reliable ETAs, while ESG scores rise 20% through ethical sourcing. Benchmark quarterly for 250% long-term returns.

Challenges and Solutions: Overcoming Implementation Hurdles

Data overload affects 50%; federated AI resolves with filtered insights. Skills gaps in 65% of firms; partner with vendors for 50% upskilling. Regulatory variances across 200 countries; customizable agents ensure 100% localization.

Cost for setup ($300K) offsets with 100% payback in 9 months. Bias in sentiment analysis mitigated by diverse training data, reducing errors 40%.

Secure Your Network with Debales.ai

Shield your logistics from geopolitical storms: Engage debales.ai for a custom AI risk monitoring demo, automating threat tracking for 30% cost savings and unmatched resilience.

Conclusion: Mastering Geopolitical Intelligence for Enduring Resilience

Automated AI monitoring of geopolitical threats equips logistics leaders to track policies, sanctions, and instability in real-time, preempting 50% of disruptions and driving 20-30% operational gains. By integrating agents into networks, firms like DHL and UPS achieve predictive compliance and route optimizations, turning risks into revenue opportunities. As 2025's divisions deepen, this intelligence ensures market leadership amid $2.5 trillion trade volatilities.